Myanmar

Profile

- to develop the accounting and auditing knowledge;

- to obtain international recognition for Myanmar professional accountants;

- to encourage members to observe the professional codes of ethics; and

- to develop the technical competence of members.

a. Apprentice Accountant; and

b. Certified Public Accountant

- holder of a Certified Public Accountant certificate;

- passed the Registered Accountant examination, has satisfactorily completed the practical training within the period of articleship;

- holds an accountancy certificate or degree conferred by any foreign country and recognised by the MAC;

- registered as a Registered Accountant under the Myanmar Accountancy Law, 1972 or a person who is entitled to be so registered.

- Advanced Accounting & Financial Reporting I,

- Cost & Management Accounting I,

- Practical Auditing I,

- Business Mathematics & Statistics,

- Financial/Service Regulations,

- Commercial Laws.

- Advanced Accounting & Financial Reporting II,

- Cost & Management Accounting II,

- Practical Auditing II,

- Taxation,

- Data Processing & System Analysis. From CPA Part II course batch No. 38 which will be opened in August 2013, Data Processing & System Analysis subject will be replaced by Business Analysis and Strategic Information System.

- Financial Knowledge & Current Economic Affairs.

Public Accountant firm

- augmenting the work force of qualified accountants, who will contribute towards the economic development of the State.;

- working for the advancement of Accountancy;

- contributing towards the development of accounting principles and practices in government departments and organisations; and

- ensuring that Apprentice Accountants, Certified Public Accountants, and Practicing Accountants observe their respective codes of ethics.

- the Auditor General as the Chairman;

- not more that 10 citizen members of the accountancy profession;

- not more than 4 suitable citizens; and

- a person assigned by the Chairman as the Secretary. At the moment the Office of the Auditor-General acts as the secretariat for the MAC.

- giving advice to government departments and organisations on matters concerning Accountancy, if such advice is sought;

- conducting, managing, and supervising training course in Accountancy conferring diplomas and certificates;

- arranging for practical training pertaining to Accountancy, prescribing the period of apprentice service and recognising the accountants who can provide training;

- scrutinising and recognising certificates and degrees in Accountancy from foreign countries, and stipulating requirements for citizens who hold such certificates or degrees to be registered;

- appointing a suitable person as the Registrar and prescribing his duties and responsibilities;

- communicating and cooperating with international accounting institutions with a view to promoting development of Accountancy;

- forming the Apprenticeship and Training Supervisory Committee with Council members and other suitable citizens;

- prescribing and/or altering the list of government departments and organisation which can provide training in Accountancy, and delegating such powers to the Apprenticeship and Training Supervisory Committee;

- reviewing as may be necessary whether the training provided at the Accountancy courses conducted under this Law is up to specified standards;

- forming necessary committees and boards and prescribing the duties thereof;

- scrutinising and allowing the establishment of professional institutions for development of Accountancy profession and providing guidance and supervision thereon;

- taking action against the Practicing Accountants who are negligent of their duties or who violate their code of professional ethics;

- carrying out measures for successful fulfilment of the objectives of this Law.

As of May 2013, there were 448 individual practicing accountants operating in Myanmar. MAC registers practicing accountants individually and there is no registration as Associate or Firm in Myanmar according to the MAC Law

Regulated Accounting Services

- Statutory Audit (Including component auditor performance)

- Financial Investigation (including Forensic Audit)

- Review Engagement

- Assurance Engagement

- Agreed upon Audit Procedure (Including Independent Internal Audit)

- Signing off as an external auditor for assurance on Account, Notification, prospectus, statement of account, report, cash-book and signature or form.

NAB Membership and/or PRA Registration

NAB Requirement:

Yes.

PRA Requirement:

Yes. Auditor must be registered as the Certified Public Accountant (CPA) (full-fledged) as well as registered as practising accountant (PA) with PRA (MAC) under personal or firm name.

NAB Membership and/or PRA Registration Requirement

(such as examination, test, recognised qualifications, etc)

NAB Requirement:

Membership with MICPA is required.

PRA Requirement:

- Entry route of 2-year 12-paper CPA Qualification requiring 3-year apprenticeship.

- Entry route of international qualification holders who pass 3-paper test, requiring 3- year apprenticeship. They must be Myanmar citizens.

- CPA and PA require registration with PRA and NAB.

- Firms need to register with PRA in their names, but not with NAB.

Citizenship Requirement

Auditor must be a Myanmar Citizen who practises in Myanmar. He/she stays within the country not less than 183 days within the calendar year for next year renewal of registration and license.

Remarks

Subject to domestic laws and regulations, such as Myanmar Accountancy Council Law and By-laws, the Myanmar Companies Law, Financial Institutions Law, Notifications issued by MAC, etc.

Eligibility requirement, where applicable (ASEAN CPA/RFPA)

ASEAN CPAs are not allowed to engage in regulated services.

Regulations for RFPA are in the process of being developed.

Currently, ASEAN CPAs/RFPAs are not allowed to practice auditing under the MAC Law; they can only engage in providing non-audit services, as mentioned above. Only Myanmar citizen Practicing Accountants are entitled to pursue public accounting

practice, as shown in the first column under Public Practice.

Non-Regulated Accounting Services

- Financial accounting

- Booking

- Cost and Management Accounting

- Preparation, compilation or reporting of financial statements

- Financial management consultancy

- Investment consultancy

- Tax consultancy, Tax Filing , Tax Calculation

- Company registration and secretarial services

- Liquidation, insolvency and receivership

- Accounting system design, development and implementation

- Accounting system review & analysis

- Internal Audit

- Accounting Education Establishment

- Share Valuation

- Business Valuation

- Other accounting related services which shall be determined by PRA from time to time

NAB Membership and/or PRA Registration

NAB Requirement:

No.

PRA Requirement:

No.

NAB Membership and/or PRA Registration Requirement

(such as examination, test, recognised qualifications, etc)

NAB Requirement:

NAB membership is not required yet.

PRA Requirement:

PRA registration is not yet required and also there is no restriction on examinations, tests and recognised qualifications. However practising and non-practising CPA (who are registered at PRA) could perform those services.

Citizenship Requirement

No.

Remarks

No. Subject to domestic Laws and regulations, such as Myanmar Accountancy Council Law and By-laws, the Myanmar Companies Law, Financial Institutions Law, Notifications issued by MAC, etc.

Eligibility requirement, where applicable

Open to ASEAN CPA / RFPA.

ASEAN nationals officially recognized as ACPAs by ACPACC under MRA. At present, RFPAs are allowed to practice non-regulated services under MAC Law.

All About Registered Foreign Professional Accountant (RFPA)

Eligibility Criteria

Non-MICPA members registered as ASEAN Chartered Professional Accountant (ASEAN CPA) with another participating ASEAN country, and wish to provide non-regulated professional accounting services in Myanmar may apply to be a Registered Foreign Professional Accountant (RFPA) with MICPA.

Under the ASEAN Mutual Recognition Arrangement on Accountancy Services (MRAA), a RFPA registered with MICPA (Myanmar) shall:

- Be bound by local and international codes of professional conduct in accordance with the policy on ethics and conduct established and enforced by the National Accountancy Body (NAB) / Professional Regulatory Authority (PRA) which the ASEAN CPA is registered with.

- Be bound by domestic regulations (E.g. immigration policies) of Myanmar.

- Work in collaboration with a professional accountancy firm or be employed by a company or organisation registered in Myanmar.

- Be permitted to provide accountancy services excluding signing off of independent auditor’s report and other regulated professional accountancy services that require a license from Myanmar Accountancy Council (MAC) and or any other relevant authorities in Myanmar.

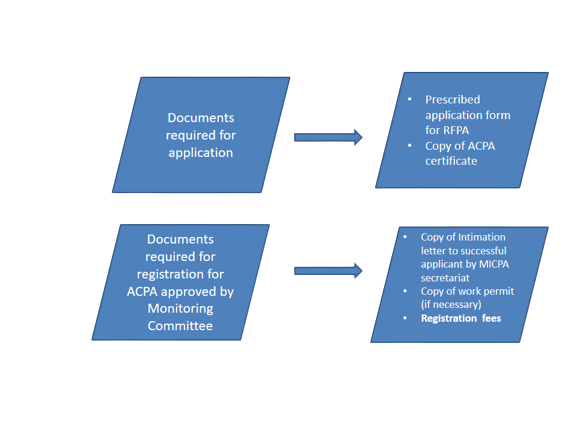

An aspiring RFPA will be required to furnish the following supporting documents at the point of application:

- Valid ASEAN CPA registration number

- Certificate of good standing from your NAB/ PRA stating that there is currently no record of any disciplinary proceedings instituted or to be instituted by your NAB/ PRA against you, dated no more than three months from the date of RFPA application. Click here for a template of the certificate of good standing for your reference.

Application

Start your RFPA application by first creating an account in the MICPA Website.

When you submit your RFPA application, you will be required to pay an application fee of US$300 (including Commercial Tax).

Please note that the application fee is non-refundable.

The application processing time is approximately twelve weeks.

Upon successful application, MICPA will inform you via email together with payment information.

The RFPA title is to be renewed annually and at an annual renewal fee of US$300 (inclusive of Commercial Tax).

For any enquiries, please email to info@micpa.org.mm.

Registration Fee : US$ 300 (including Commercial Tax)