As we are currently in the era of Industry 4.0, nearly all industries in the world be it accounting, finance, manufacturing, domestic goods and services, retail, healthcare, and various other industries have adopted some form of technology to help facilitate and make their routine and regular processes more efficient as well as to cut costs while running their businesses and providing and producing goods and services.

It goes without saying that in the case of the Accounting and Finance industry dismissing the opportunity of adopting modern technology to facilitate regular and routine tasks, there will definitely be a lack of efficient performance and more time and energy wasted that would be better off spent on more cognitive tasks.

There are various forms and categories of technology that can be adopted and applied to essentially any industry – the first step is to find a suitable use case for it. Oftentimes, experts in each industry will co-operate with Technology and Research and Development experts to assist in identifying and selecting the essential technologies for each industry according to their business and service needs. They must take into account and have an overview of the basic dynamics of different industries and how they work together to produce their goods and services and help to identify problems within the processes and inner workings of the industry that can be made more efficient. However, it is crucial to note that adopting more technologies does not necessarily guarantee improved performance – industries must work in coherence with Chief Technology Officers (CTO) and Chief Information Officers (CIO) to help identify and select the most suitable technologies for their field of work. Sometimes adopting an excessive amount of technology can lead to reduced and oftentimes less than optimal performance for industries.

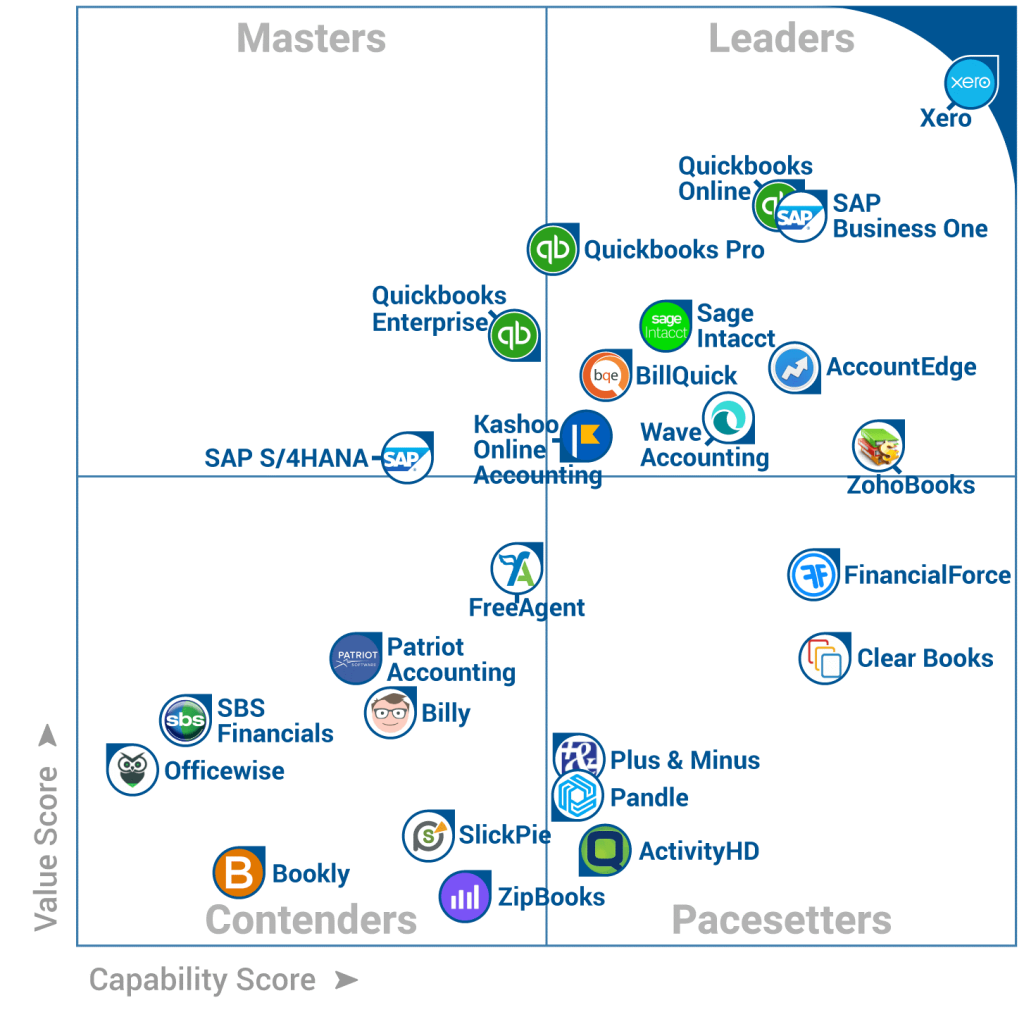

An effective and well-informed guideline and framework to utilise to make a decision on what types and niches of software to adopt is by applying the Gartner Magic Quadrant to a company within an industry. The Gartner Magic Quadrant is a visual method of reporting. Magic Quadrants are used to depict which companies are leading the way within a specific market. The significance of this framework is to assist companies and businesses to identify and select the most suitable, affordable, and viable software product and/or service for their business needs and project scope. In this case, we will be applying it to the Accounting and Finance Industry.

Visual depiction of a Gartner Magic Quadrant

Figure 1 Gartner Magic Quadrant for Accounting Software

Let us breakdown the Gartner Magic Quadrant for Accounting Software – The Gartner Magic Quadrant is divided into 4 Quadrants: Challengers, Leaders, Niche Players, and Visionaries or in this case Masters, Leaders, Contenders, and Pacesetters. Each of the candidates’ placed within each quadrant will be assigned to at least one of the 4 categories based on their performance and feedback from users in the market and the quality of development and maintenance of their products and/or services. In terms of Masters, Quickbooks Enterprise, SAP S/4HANA, and Quickbooks Pro take precedence – these software perform well; however they provide limited ideation in terms of how the current market will develop and evolve. In the Leaders quadrant we have Quickbooks Pro, Kashoo Online Accounting, Wave Accounting, ZohoBooks, BillQuick, Sage Intacct, AccountEdge, SAP Business One, Quickbooks Online, and Xero. These software perform well and are proficient in terms of market development. In the Contenders segment, FreeAgent, Patriot Accounting, Billy, SlickPie, ZipBooks, Bookly, Officewise, and SBS Financials occupy said segment. These software perform well in their own niche of the market and rarely innovate to expand and advance their market. In the last Pacesetters segment, we have Plus & Minus, Pandle, ActivityHD, FinancialForce, and Clear Books occupy the segment. These software focus primarily on innovating the market and have limited experience and functionality in terms of performing.

In terms of how to use the software, once you have completed an invoice, you have several options on how to save the document – you can either save it as a draft or as a final version or print it or email it. You can also create a PDF version of the invoice, copy it, record payments made on it, and set it up to recur on a regular timeline.

If, for example, you are travelling and need to keep track of your expenses, you can take pictures of the receipts using your smartphone. Some software such as Intuit QuickBooks Online and Neatbooks, read the receipts and transfer some of the receipt data (such as date of transaction, vendor, and amount) to an expense form using OCR (Optical Character Recognition) technology.

Before any corporate company decides on what kind of software they wish to adopt – they must first ask the right questions: “Where is the problem in my firm, and what is the actual problem?” Another aspect that professionals must consider is the work structure and what kind of tasks will be delegated to human professionals and which tasks will be delegated to AI (Artificial Intelligence) software. Professionals must also consider the complexity and length of a certain task – A professional may only require 4 to 5 steps to map out a specific process while an amateur may require 3 times as many steps and explanation to complete the same task. Expanding further, it might take 60 steps to plan and explain a certain process to an outsourced worker; more so if there is a language barrier between the professional and the worker. In such cases, time as a resource is sacrificed. However, the more detailed and structured the process is, the easier it will be for AI (Artificial Intelligence) software to interpret and understand the task – more detailed and granular data will be uncovered and utilised to complete the tasks at a much accelerated pace (provided that professionals and practitioners have already chosen a suitable software for their use case and problem at hand).

Another factor that professionals must consider is the time it takes to train their workers and themselves to learn how to use such software provided that the projected benefits and business value have been identified and anticipated. Professionals will need to spend both time and money to purchase and setup the software that they sought out to use and to train their employees how to use the software.

It is safe to assume that various business processes in the Accounting industry are better off automated rather than requiring a person to tediously spend their precious time on repetitive mundane tasks. A solution to this inefficiency is to automate certain tasks and processes that are not cognitively intensive and that do not bring as much business and monetary value to the company. This time and effort would be better off expended on brainstorming ideas on how to expand a business’s client base. There are various open-source applications that virtually anyone can sign up for and setup their workflow within the application. Of course the degree to how user-friendly the application is may possibly make or break the resilience and willingness of people to use the system, but nonetheless it is always better to automate processes wherever possible. In the case where the user-interface of the application proves difficult for people to navigate, then it is advisable to consult the creator of the application or a User Interface (UI) design expert to help clear any areas of confusion in terms of using and navigating the application. A few applications that provide such services and functionality include Wave, Lexoffice, FreshBooks, Zoho Books, Moneybird and an extensive list of various other open-source and proprietary software.

In terms of how a company can expand their client base, they must first gather information on their target clients and leverage it to their advantage. The simplest way to start is to use social networking sites. Websites such as LinkedIn, Slack, Twitter, and Facebook are more business friendly in comparison to other social networking sites such as Instagram and Tumblr. Users can connect and send files to each other on the platforms, publicise their company and services as well as simultaneously attract more potential clients by receiving ‘followers’ on their account and vice versa.

Another non-technical approach to utilising technology to connect with more clients is to conduct virtual meetings. Online meetings provide clients and service providers’ alike the flexibility of time and location which allows both parties to schedule meetings according to their workday. With the recent Covid-19 pandemic, platforms such as Zoom, Google Meet, Microsoft Teams, and Skype were frequently used to allow clients and service providers to exchange information despite the ongoing pandemic. Users can share their screen which allows users to discuss and perform tax returns, revise financial reports, and assist with other client documents – without incurring any additional overhead. Useful features that Zoom includes are virtual whiteboards, breakout rooms, and direct messaging to one or all participants. If participants are unable to attend, meetings can be pre-recorded prior to the start of a meeting and sent to the associated participants who were unable to attend; this way the organiser and attendees of the meeting need not walkthrough the entire meeting again and participants who were unable to attend can send their respective questions to the organiser if they require further clarification regarding certain tasks and milestones of a project. Another benefit of using online meeting platforms is that some platforms such as Zoom allow up to 200 participants to attend a single meeting. A possible challenge that users may experience during an online meeting is the latency of participants’ wireless connectivity and that of meetings’ organisers and participants also run the risk of having their meeting being hijacked by unauthorised attendees and their privacy sabotaged. Therefore it is crucial that meeting organisers setup an authorisation key that can only be accessed by registered participants to ensure that the meeting is less susceptible to such attacks.

As the modern generation of technology users are an ‘always-online’ generation – it is also essential for CPAs to be able to respond to enquiries from clients on the spot. Platforms such as Whatsapp, Telegram, Facebook Messenger, and Line are a few instant messaging platforms that are commonly used today. Apart from messaging capabilities, clients and practitioners can also share, access, and store files on platforms such as OneDrive, Dropbox, and Google Drive that provide such file sharing capabilities. Cloud management, editing, and collaboration software are also among the various tools that CPAs can utilise – such platforms allow clients and practitioners to make and review comments on documents, invoices, and payments.

Cloud Core Financial Management Suites are yet another financial software platform for enterprises of all sizes. According to Gartner’s definition, core financial management suites include:

- The functional areas of general ledger (GL), accounts payable (AP), accounts receivable (AR), fixed assets (FA), project accounting, project costing and project billing.

- Financial analytics and reporting capabilities

- Basic indirect purchasing functionality. This market focuses solely on core financial management suites that are marketed and sold on a stand-alone basis and delivered as cloud services. It does not cover vendors that sell only a broader ERP (Enterprise Resource Planning) suite that includes core financial management applications.”

Examples of Cloud Core Financial Management Suites include Sage Intacct, Workday Financial Management, Oracle Fusion Cloud ERP, Microsoft Dynamics 365 Finance, SAP S/4HANA Cloud, Acumatica Cloud ERP, Oracle NetSuite ERP, FinancialForce Accounting, Ramco ERP on Cloud, Focus ERP, Unit4 ERP, Accounting Seed, ERP Cloud Financial Management Software, Intuit QuickBooks, ERPNext, and other software.

An essential process to be used in the event that a business plans to adopt field specific technology is Business Process Outsourcing (BPO). In simple terms, outsourcing business processes involves delegating less urgent business related tasks to third-party vendors. Businesses often outsource processes such as accounts payable, financial reporting, and payroll to third-party vendors. Of course certain policies and procedures are setup in the case that those tasks contain classified and sensitive business and company related information to ensure that the third-party vendors handling those tasks do not disclose said information without the company’s permission. The topic of privacy and security of business information in relation to technology is fundamental and vast and will be discussed in the later part of this article.

Additional software that CPAs can install are data visualisation tools such as Microsoft Power BI and Tableau that allows users to create dashboards, maps, and interactive charts. These software platforms provide extensions to Microsoft Excel to manipulate the data within cells to create visualisations according to users’ needs. Such capabilities provide users with an overview of data – providing valuable insights and implicit information with the ability to create a timeline of how the data spans over time and how companies and users can imply and use the new information at hand. As the saying goes “A picture is worth a thousand words” – the capacity to create and explain data visualisations in a clear, coherent, and concise manner provides practitioners a significant edge over professionals who have limited to no knowledge of how to use and interpret the software; the modern generation of clients often work and operate on the go; so it should not come as a surprise that they only have time to skim through extensive documents while they work. Therefore, practitioners who are competent in using data visualisation software will be able to save time for both themselves and their clients. Such platforms also allow data analysis and manipulation.

Another software capability or process that CPAs can take advantage of are RPAs (Robotic Process Automation) of which software can be applied upon existing organisational systems (for example: ERP (Enterprise Resource Planning) systems, MYOB, email systems and so on) rather than being fully integrated into those systems. Robotic Process Automation platforms provide useful capabilities for developing and managing bots that execute scheduled and assigned tasks. Such capabilities include parsing and reading text and recording data into online forms. An added advantage of using bots to carry out certain simple tasks is that their work process is often more transparent and they can be monitored by the existing platforms that they sit atop of (which provides additional information on management and efficiency of use) and also by employees of the company. This also means that any tasks carried out by the bots are more readily auditable. Some RPAs (Robotic Process Automation) software can be upgraded with artificial intelligence capabilities, in which case the term Intelligent Process Automation will be used instead. Tasks that can be easily carried out by Robotic Process Automation software include payroll, bank reconciliation, accounts payable, and accounts receivable related tasks. The purpose of RPA (Robotic Process Automation) software is not so much about outsourcing such tasks but rather finding ways to make the tasks more efficient and productive. However, one must consider certain aspects of RPA (Robotic Process Automation) software – the software is only able to complete a task as well as it is defined according to a certain set of procedures and formats. RPA (Robotic Process Automation) is not a replacement for human judgment – it has little impacts in terms of activities such as interpretation and decision making. Applying RPA (Robotic Process Automation) to internal data and systems is simple in the sense that the input data sources that are well structured and labelled have been identified (for example: a PDF (Portable Document Format), Excel spreadsheet, or a system generated report) – and therefore it is easy to write the script that the bot will use to perform the task at hand. RPA (Robotic Process Automation) is particularly useful in tasks that involve routine data manipulation: transferring data from one system to another, merging data from two systems, sorting, organising, and routing data. Business and accounting application of RPA (Robotic Process Automation) are often driven by a desire for cost reduction, and greater speed and efficiency in the execution of tasks (Carey, 2019). RPA (Robotic Process Automation) can also be used in the field of sales and marketing. RPA (Robotic Process Automation) also lends itself to ensuring consistency in the tasks it carries out, and a clearer audit trail for activities that would have otherwise been handled through manual processes (Deloitte, 2018b). One must also note that RPA (Robotic Process Automation) is about automating tasks, not entire processes, or fully automated systems. While the RPA (Robotic Process Automation) platforms have the ability to enable end-users to develop bots, it is essential that sufficient oversight and control over development and deployment of those bots are ensured; lest faulty and unusable bots be developed.” Given the high-volume nature of tasks that the bots perform on a daily basis, any errors can have significant effects on connected systems fairly quickly. If such problems do arise, they should be traceable as the bot’s script provides set transparency rules for any data acquisition or data processing activity. IT staff, working in cooperation with business operations staff can help to ensure that the development process of bots are appropriately managed and handled. As RPA (Robotic Process Automation) bots consistently follow a script, they can also help to ensure the accuracy of data acquired and thus provide assurance evidence in regards to evaluating data reliability.

Along with its associated benefits, the utilisation of technology is also coupled with their associated risk factors; and this involves (but is not limited to) the security, privacy, and confidentiality of both clients and practitioners. The field of privacy and security of information is an ever-developing and evolving field as ever more penetrators attempt to infiltrate the databases and inner-intelligence of companies and businesses. It is well-worth investing in information security technology and software – given that there are perpetrators who continuously discover new ways to infiltrate and hijack data, it is essential to update corporate information security software regularly.

To further ensure the security of corporate information, it is crucial to ask the essential questions:

- What are the cloud provider’s privacy standards?

- What are the company’s responsibilities for security?

- What are the cloud service provider’s responsibilities in terms of security?

- Does the service provide an audit trail for all financial and/or audit transactions?

It is also crucial that corporate professionals take responsibility for their data in terms of setting strong passwords and ensuring that confidential information is limited to access by authorised users only. In the possibility of information being breached and stolen, it is always advisable to keep a backup of your data in an external hard drive. Of course, stored data must be scanned beforehand to ensure that none of the data files are corrupt – otherwise all of the files will be affected.

Extending further on the topic of security, there are two types of security: Cloud Security and On-Premise Security. Cloud Security relates to the systems, tools, and processes you use to access, share, and protect data through third-party cloud-based applications. On-Premise Security relates to anything not related to the cloud such as the devices and antivirus software that a company employs, software and hardware updates, storage, network connections, file settings, and so on. Cloud security can be managed centrally while On-Premise assets need to be configured, updated and backed-up regularly. There are five key “non-cloud” areas that you should focus on protecting and securing in your firm:

- Endpoint Security

Endpoint Security consist of the devices that are used to conduct business transactions and practices such as desktops and laptops, tablets and mobile phones, and servers and printers.

The most important security tips to keep in mind include:

- Installing Antivirus software

- Update your Windows Operating System regularly

- Configuring access via your company network

- There are 2 ways to gain access to a Windows computer – either locally or via a network.

- Ensure that individual computer logins do not affect the entire network

- Delete old user accounts

- Restrict the number of admin users

- Local Storage

- Ensure that your downloads and recycle bin folders are cleared regularly. – If those folders contain any confidential files, then your firm might be at risk.

- Establish policies for local software installation

- Unauthorised software can unintentionally install malware unbeknownst to the user.

- Setup a password to authenticate local installations of software to devices and the network.

- Regularly review software installed on company devices

- Ensure that passwords are removed from browsers

- File Settings

- Control permissions to different types of files

- Regularly review which users have access to which files

- Control the number of administrators

- Control which files are synced to the cloud

- Network

- Update your router’s default password

Each router model has a default password. Ensure that passwords are updated regularly to ensure hackers are unable to gain access to your router.

- Create a Guest network for non-firm devices

- Avoid public WiFi whenever possible (unless you are using a VPN)

If there is no other alternative, then ensure that your firm uses a VPN which provides end-to-end encryption

- Remote work

- Provide company devices wherever practical

- Ensure that all devices that employees work on are covered by company-managed antivirus software.

- Ensure that you have IT Staff and an Internet Policy in place

- Geo-fence remote work facilities using cloud security software (i.e. only allow access to your network and apps from approved locations at approved times.)

To bring a technological software agreement full circle (that is once experts and CPAs have finally decided on a software to use), they can seal that agreement with a smart contract. In short, a smart contract is a self-executing contract with the terms of the agreement between vendors and clients being directly written into lines of code. The code and the agreements contained therein the contract exist across a distributed, decentralised blockchain network. The code controls the execution, and all associated transactions tied to the contract are trackable and irreversible. As we are on the topic of contracts, the company, JPMorgan Chase, deployed natural-language processing software in 2016, enabling the company to sift through 12,000 commercial-loan contracts in a matter of seconds, compared to 360,000 hours of human processing time. The Natural-Language Processing software is 30 times faster in terms of processing speed compared to human processing efforts. It is no doubt that the sooner practitioners and professionals are to adopt and understand how to apply such technologies to their practice, the sooner they will be able to save time, as the need for humans to manually process and sift through piles and piles of paperwork will soon become redundant and inefficient.

Albeit the blockchain industry is still in its infancy and is still experiencing issues and inconsistencies in relation to the correctness of the data entered into the decentralised digital ledger – professionals still need to educate themselves in regards to the basics and surface level knowledge in regards to how blockchain will affect related external processes. Basic functional understanding to appropriately consider as to how the use of blockchain applications poses risks and implications (for example: limitations of data reliability or integrity within the blockchain network – such as input validity issues) in the accounting and business industry.

In commercial terms, once professionals and practitioners have consulted a technology advisor, setup their software, established and tested the security infrastructure of their software, and sealed the agreement with a smart contract – there is one essential point to consider, the billing methodology of how the cost of the technology will be incorporated into the financial records and reports of the company. Corporate companies and services have long relied on the human capital model of how income and loss are incurred within a company. The characteristics of the human capital model are based on the skills (communication, technical, problem-solving, interpersonal), qualifications, education, creativity, experience, expertise, working hours, and so on). These more or less quantifiable and measurable characteristics are what encompass and allow employers to determine the overall value and/or profit that an employee will generate while serving the company. However, the case is radically different when experts decide to employ technology into their company (especially if they are unfamiliar with it). There is no definite way to know how the software will perform (especially if little to no one is fully equipped on how to use the software). The only way to know for sure how much value the software will generate in the long run is to actively use it – otherwise CPAs may have to ask and trust the information that their vendor provides related to customer feedback for the software. Another way to assess the profitability of a particular software is to perform thorough research on the software on how the software performed for small, medium, and large enterprises. Professionals may find that high-end and specialised software may not work as well for large companies as they do for small companies; so it is critical to choose the most suitable software for the size and nature of your company, client, and business needs. Value pricing or project pricing provides companies with a new methodology to measure revenue from the services that they offer rather than counting the hours billed according to human clock-in-and-clock-out hours. Some companies have been sceptical in terms of shifting from the traditional pricing and billing system based on the number of billable hours per employee, which has been the norm for decades.

As professionals come to realise the benefits associated with utilising technology to its fullest potential – along comes with that realisation the surplus of time that was previously spent on crunching financial reports and sifting through stacks of paperwork. Professionals now have to learn how to use their newfound time to better connect and serve their clients in a more holistic rather than technical manner – instead of auditing financial reports, professionals can spend more time auditing their methodologies and business practices in relation to their clients and employees (as in how they can serve them better) and more time auditing a product and/or services’ KPIs (Key Performance Indicators) and how they affect the business value of the company on a daily basis. The modern professionals of today need to look beyond the numbers and must learn to collaborate as well as think and behave more strategically.

References

https://www.pcmag.com/picks/the-best-small-business-accounting-software

https://www.gartner.com/en/research/methodologies/magic-quadrants-research

https://www.journalofaccountancy.com/news/2019/jun/technology-for-tax-cpa-firms-201921293.html

https://www.gartner.com/en/documents/3956304

https://www.investopedia.com/terms/s/smart-contracts.asp

https://www.journalofaccountancy.com/newsletters/2018/apr/robots-already-here.html

https://www.journalofaccountancy.com/issues/2018/jun/accounting-technology-roundtable.html

https://www.armaninollp.com/articles/leverage-technology-transform-finance-accounting/

by Katherine Lee Chin Fei, Manager, Katherine Lee & Company